A comparison of Augusta Precious Metals vs Competitors reveals surprising differences in fees, service, and reliability. I tested the top gold IRA companies to find the real winner.

Over the past three months, I thoroughly researched gold IRA companies. After seeing my retirement account fluctuate significantly and experiencing an 18% decline in my 401(k) last year, I became concerned about potential future losses.

I began exploring precious metals IRAs, not out of alarmism, but because relying solely on stocks and bonds was making me uneasy.

The challenge is that many companies claim to be the best, and several have unprofessional-looking websites.

I narrowed my options to the most reputable companies: Augusta Precious Metals, Goldco, Birch Gold Group, and American Hartford Gold. I then contacted each of them directly.

I spoke with their representatives.

Asked annoying questions. Read through their fee schedules until my eyes crossed.

This Augusta Precious Metals comparison is what I came up with after all that homework.

The Companies I Actually Looked At

I focused on four companies that kept showing up in my research and had decent reputations.

Augusta Precious Metals has a large following and has received several awards. Their marketing emphasizes education and transparency.

Goldco is another well-known company with many positive reviews. They have operated since 2006 and have a partnership with Sean Hannity.

Birch Gold Group has been in business since 2003 and is known for accommodating smaller account sizes.

American Hartford Gold is a newer company experiencing rapid growth and invests heavily in advertising.

I left out some of the smaller companies because I wanted to compare apples-to-apples and to include companies that had been around long enough to have a real track record.

Breaking Down What Actually Matters

Minimum Investment Requirements

This is where the differences become apparent.

Augusta Precious Metals requires a minimum investment of $50,000. Initially, this almost led me to exclude them from consideration.

That’s a serious chunk of money to move around.

Their representative explained that the higher minimum allows them to offer more personalized service and better pricing on metals. Still substantial, but more accessible if you’re just starting to diversify.

Birch Gold Group falls to $10,000. This made them attractive if you want to test the waters without committing huge amounts upfront.

American Hartford Gold advertises no less, which sounds great until you realize they still recommend at least $10,000 to make the fees worth it.

Initially, Augusta’s minimum investment was a concern. However, after evaluating my own situation, I found that if you are transferring a significant portion of retirement funds, the higher minimum is not a major obstacle.

It simply indicates they are focused on a specific client profile.

Fee Structures (The Part Everyone Hates)

To be clear, all of these companies charge fees. Any claim to the contrary is inaccurate.

The question is whether the fees are reasonable and clearly explained.

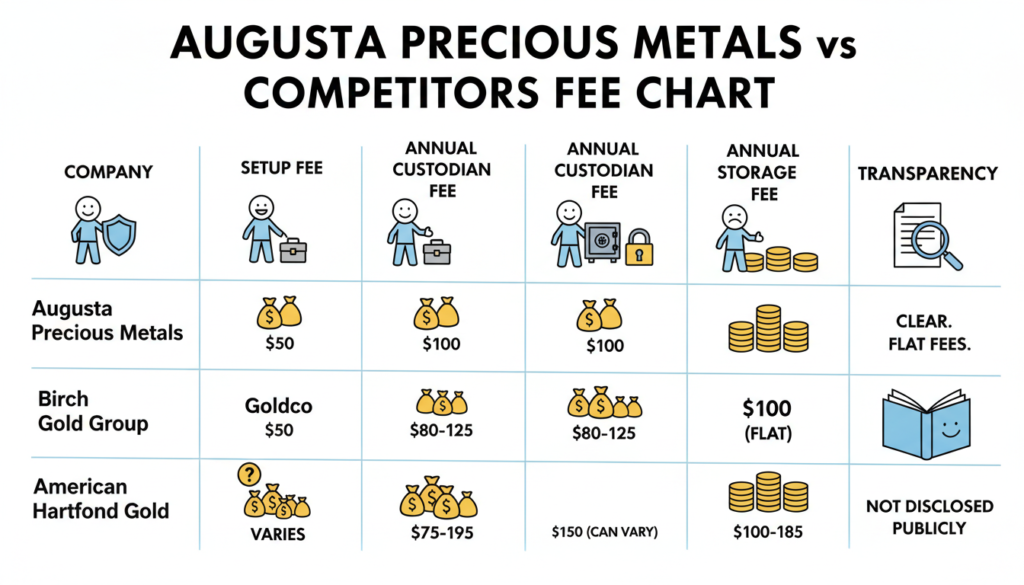

Here are my findings regarding fees in this Augusta Precious Metals comparison:

Setup and annual fees are similar across all companies. Augusta stands out for its flat storage fee.

Regardless of the amount of gold stored, the annual storage fee is $100.

Period.

Other companies may increase storage fees based on the value of your holdings. If gold prices rise, this could result in significantly higher storage costs over time.

Dealer markup, or the amount charged above the spot price for gold or silver coins, is a key consideration.

None of the companies disclose this information publicly, which I found frustrating.

You must call to obtain a quote. Based on my conversations with representatives, Augusta’s markup is competitive, though not always the lowest. However, they argue that their pricing is more stable and they don’t play games with “special promotions” that disappear when you actually try to buy.

The Actual Buying Experience

I conducted test calls with all four companies, posing as a prospective client to evaluate their account opening processes.

Augusta assigned me to a rep pretty quickly. The guy spent like an hour on the phone with me (I didn’t ask him to, he just kept going).

He discussed economic factors, explained how IRAs function, and reviewed various coin options.

The conversation was informative and educational, with no sales pressure.

At the end, he explained that I would need to complete a web conference before opening an account.

This web conference is mandatory, lasts about an hour, and covers topics such as economics, inflation, the role of precious metals in a portfolio, and associated risks. While some may find this inconvenient, I appreciated the thoroughness.

They are committed to ensuring clients fully understand their investment decisions.

Goldco’s approach was more traditional and sales-oriented. The representative was knowledgeable but focused on closing the sale.

They offered a promotion that included free silver with my account.

I am generally cautious about “free” offers, as the costs are often incorporated elsewhere.

Birch Gold provided a balanced experience: professional, informative, and not overly aggressive.

They sent a comprehensive information packet following our conversation.

American Hartford was the most aggressive, making multiple follow-up calls.

The representative emphasized limited-time offers and the urgency of protecting my retirement savings.

The experience was reminiscent of high-pressure sales environments.

If you want a company that’s going to slow down and make sure you’re educated before taking your money, Augusta wins this category hands down. You can check out Augusta’s current offerings here, they’ll walk you through everything before asking for a commitment.

Customer Service and Support (After You’re Already a Customer)

This aspect was more challenging to research, as I am not a customer of all these companies. I relied on reviews, complaints, and conversations with actual clients.

Augusta has something called “lifetime support” which means your original rep stays your contact person for as long as you’re a customer. I talked to a few Augusta customers (found them in online forums) and they confirmed this is actually true.

One guy said he’s been with them for four years and still talks to the same person when he has questions.

Other companies assign a representative initially, but clients may be transferred to different staff members depending on their needs. This approach is less personal but not inherently negative.

Augusta also maintains an impressive complaint-free record with the BBB and other consumer protection organizations. As of my research, they had zero BBB complaints, which is notable for a company established in 2012.

This suggests they are either providing exceptional service or proactively resolving issues before they escalate to formal complaints.

Goldco has some complaints (like 14 or so), mostly about delivery times and miscommunication. Nothing terrible, and not spotless.

Smaller companies have occasional complaints, typically regarding delayed orders, high-pressure sales tactics, or unclear fee structures.

Product Selection and IRA Options

All four companies offer similar IRS-approved gold and silver products for IRAs, such as American Gold Eagles, Canadian Gold Maple Leafs, and American Silver Eagles.

The IRS has strict requirements for precious metals IRAs, including specific purity standards, so product variation is limited.

The primary difference lies in the guidance provided regarding product selection.

Augusta recommends specific products based on liquidity and resale value, offering clear opinions on what is most suitable for clients.

Their representatives provide direct feedback if they believe a particular option is not appropriate for your situation.

Other companies typically present all available options and allow clients to choose. While this flexibility can be appealing, clear recommendations are often more helpful for those new to the process.

Augusta also sells precious metals for direct purchase (not in an IRA). To keep some physical gold at home or in your own safe deposit box, they’ll work with you on that too.

The Education Component

This was actually a huge differentiator in my Augusta Precious Metals comparison.

Augusta places strong emphasis on education, including the mandatory web conference mentioned earlier.

They also have a ton of free resources on their website, videos, guides, articles about economics and precious metals investing.

Their blog provides genuinely useful information rather than solely promotional content.

Isaac Nuriani (the company’s CEO) and Devlyn Steele (their director of education) do regular video updates about the economy and precious metals markets. You can watch these even if you’re not a customer.

The content is informative and engaging.

Other companies also provide educational resources, but these tend to be more generic and lack the same depth.

If you’re someone who wants to really understand what you’re investing in and why (which you should be), Augusta puts way more effort into teaching you. Check out their educational resources here before making any decisions about precious metals investing.

The Trust Factor

Trust is an important but difficult factor to quantify when considering companies to manage significant retirement savings.

Augusta demonstrates several strengths in this area:

They’re rated A+ with the BBB and have been for years. They have basically no complaints filed against them.

They’ve won a bunch of awards from consumer protection organizations.

They are transparent about their process and fees, although the actual markup on metals is not published on the website.

They also avoid marketing tactics that could raise concerns, such as fear-based messaging about economic collapse.

They do not use celebrity endorsements or alarmist advertising.They avoid high-pressure sales tactics, instead providing straightforward information and maintaining a professional approach.

That might sound like faint praise, but in an industry where a lot of companies use scare tactics to get people to buy gold, boring and professional is actually pretty refreshing.

The company has operated since 2012 and has weathered various economic cycles, demonstrating stability and reliability.

Goldco has similar credentials and a longer track record (since 2006). They’re also well-regarded. The celebrity endorsement thing (Sean Hannity) either helps or hurts depending on your perspective.

The other companies are reputable but are either less established or have more varied complaint histories.

Storage and Security

All of these companies use segregated storage at places like Delaware Depository. Segregated storage means your specific coins are separated from everyone else’s, not just pooled together.

Clients may visit their stored metals if desired, although this is uncommon.

This is pretty standard across the industry, so no real differences here. Your metals are insured while in storage.

The depositories are serious operations with proper security.

You’re not going to wake up one day and find out your gold is gone.

Augusta uses Delaware Depository exclusively. Some of the other companies give you options between different storage facilities.

This distinction is minor, as all storage facilities used are reputable.

Buyback Policies

Eventually, you might want to sell your precious metals. Maybe you need the cash.

Maybe gold prices shoot up and you want to take profits.

Maybe you just change your mind.

Augusta guarantees they’ll buy back any precious metals they sold you. No restocking fees or penalties.

They pay based on current market prices.

The process is straightforward.

The other companies have similar buyback policies. This is standard practice.

Where companies sometimes differ is in how quickly they process buybacks and whether they charge any fees.

Augusta’s policy appears to be fee-free and relatively quick, typically processing buybacks within a few business days, though I have not tested this personally.

Real Customer Experiences

I reviewed discussions in online forums and social media groups to gather insights from customers of these companies. Here are my findings:

Augusta customers are generally very satisfied, with many expressing strong enthusiasm.

Clients often mention their representatives by name.

They mention feeling informed and not pressured. The main complaint I saw was about the high least investment keeping some people out.

Goldco customers are generally positive as well. Some noted that the sales process felt somewhat aggressive, but most were satisfied with the service and products.

Birch Gold receives mixed reviews. Some clients are highly satisfied, while others experienced inconsistent communication and frequent changes in representatives.

American Hartford receives the most varied feedback, with some positive reviews but more frequent complaints about aggressive sales tactics and pressure.

Who Actually Wins This Thing?

Based on my research, Augusta Precious Metals is the best choice for individuals seeking to transfer a significant portion of retirement savings into precious metals and who value strong client service.

Here are the reasons Augusta is my preferred choice:

The educational component is genuinely valuable. The web conference, while an additional step, ensures clients fully understand their investment.

Many individuals enter gold IRAs out of fear or due to aggressive sales tactics, only to regret the decision later.

Augusta’s approach helps mitigate this risk.

Lifetime support from a dedicated representative is more valuable than I initially realized. Having a single point of contact who understands your account simplifies future interactions.

The fee structure is transparent and predictable. Flat storage fees prevent unexpected cost increases if gold prices rise.

The absence of complaints with the BBB is remarkable. Companies do not maintain perfect records by chance.

They achieve this by providing excellent customer service and resolving issues promptly.

The absence of high-pressure sales tactics is reassuring. I am cautious of any company that attempts to rush decisions involving significant financial commitments.

If you’re seriously considering moving retirement funds into precious metals, I’d start with Augusta, their educational approach and transparent process make them the safest bet for this kind of investment.

The Downsides

No company is perfect, and Augusta has some legitimate drawbacks.

The $50,000 minimum investment is high. If you wish to start with a smaller amount, Birch Gold or another provider may be more suitable.

While Augusta’s higher minimum supports better service and pricing, it excludes those who prefer to begin with a smaller investment.

The mandatory educational conference requires a time commitment. For those who have already conducted extensive research and wish to set up an account quickly, this step may feel unnecessary.

However, even well-informed investors may find valuable information in the presentation.

The company maintains a conservative image and does not engage in flashy marketing.

No celebrity endorsements.

There are no exciting promotions. If you prefer promotional offers, other companies may be more appealing.

Personally, I prefer a conservative approach when it comes to retirement savings.

Other Options Worth Considering

If Augusta is not the right fit, consider the following alternatives:

Choose Goldco if you want a reputable company with a lower minimum investment of $25,000. They are comparable to Augusta in most areas, though slightly less focused on education and with marginally higher storage fees.

Consider Birch Gold if you are investing less than $25,000 or prefer a more flexible sales process. They are reliable, though not as refined as the top two options.

American Hartford Gold may be suitable if you prefer their approach or have a strong referral. They are not a poor choice, but their aggressive sales tactics may not appeal to everyone.

What I’m Actually Doing

After completing my research, I have decided to proceed with Augusta. The $50,000 minimum suits my situation, and their overall approach aligns with my preferences.

I appreciate their emphasis on ensuring clients fully understand their investment decisions.

I value having a dedicated representative and a flat fee structure.

I am allocating approximately 15-20% of my retirement funds to precious metals as a hedge against inflation and market volatility, while maintaining the remainder in traditional accounts.

The rest stays in my regular retirement accounts.

This level of diversification aligns with my investment strategy.

The setup process is expected to take a few weeks. I will complete the web conference, collaborate with their team to roll over funds from my 401(k) into a self-directed IRA, and then purchase gold and silver.

Their representative indicated that they manage most of the paperwork and coordinate with my current 401(k) administrator.

I plan to provide an update after completing the process and maintaining my account for some time. Based on my research, I am confident in this decision.

Final Thoughts

Selecting a precious metals IRA company should be straightforward, but due diligence is essential due to the presence of less reputable operators. Avoid choosing based solely on marketing or aggressive sales tactics.

Prioritize companies with strong reputations, transparent fee structures, and educational resources that support informed decision-making. Do not allow anyone to pressure you into a decision.

Take your time.

Ask thorough questions and request clarification as often as needed.

For me, Augusta Precious Metals met all key criteria. While not perfect, they are the most trustworthy option I found for transferring a significant portion of retirement savings into physical gold and silver.

The peace of mind of having some of my retirement funds in something tangible (instead of just numbers on a screen that bounce around every day) is worth the fees and the higher least investment.

If you wish to learn more about Augusta, you can request their free guide for an overview without commitment. Be prepared for a follow-up call from a representative.

They are not aggressive, but they will follow up.

Regardless of your decision, ensure it is based on sound reasoning. Precious metals IRAs are best used as part of a diversified retirement strategy, not as a reaction to market volatility or alarming news.

Educate yourself, understand your investment, and choose a company you trust.

This is my honest conclusion from the Augusta Precious Metals comparison. I hope it helps you make a more informed decision.