Discover Augusta Precious Metals’ products, the account setup guide, and strategies to protect your retirement savings with gold IRAs. This is an objective guide for 2026.

With my investments concentrated in stocks and bonds, ongoing news about inflation and market volatility became a significant concern.

During my research, Augusta Precious Metals consistently appeared as a reputable option. After speaking with their team and several other companies, I compiled this guide to share my findings.

Introduction to Augusta Precious Metals

Founded in 2012, Augusta has established a strong reputation in the precious metals industry. The company holds an A+ rating with the Better Business Bureau, which is significant when considering a retirement investment.

Their approach to customer interactions is notable for its absence of high-pressure sales tactics.

Unlike some other gold companies that use persistent follow-up calls, Augusta’s approach is more respectful and client-focused.

They provide clear answers, explain the process, and allow clients to make informed decisions.

The company specializes in assisting clients with adding physical gold and silver to their retirement accounts.

They do not offer cryptocurrencies, rare collectible coins, or unrelated products.

Their offerings are limited to IRA-eligible gold and silver.

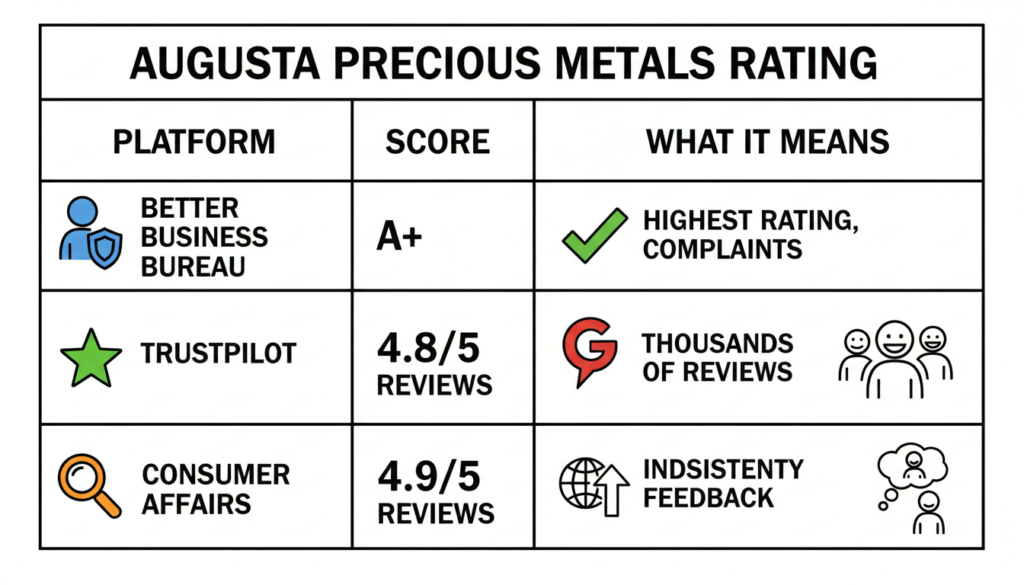

Their customer ratings speak for themselves:

These ratings reflect actual client experiences rather than marketing claims.

Product Categories Overview

Augusta maintains a straightforward product lineup, offering only IRA-eligible gold and silver coins and bullion.

No additional products are offered.

They do not offer platinum, palladium, or collectibles of uncertain value.

Gold Products

The gold offerings include IRS-approved coins like American Gold Eagles and Canadian Gold Maple Leafs, all with a minimum .995 purity and global liquidity.

All gold products offered by Augusta for IRAs meet IRS standards, eliminating uncertainty regarding eligibility.

That removes much of the uncertainty from the process.

Silver Products

Silver products are also limited to coins and bullion that meet .999 purity standards.

Silver typically carries a higher premium over spot price than gold, due in part to higher storage and handling costs relative to its value.

Both metals are shipped with full insurance to partner depositories, including Delaware Depository in Wilmington and International Depository Services in Dallas.

Metals are stored in segregated accounts, ensuring your holdings remain legally separate from the depository’s assets.

This segregation protects your assets in the event of an issue at the depository facility.

How to Choose the Right Product

Choosing between gold and silver depends on your investment objectives and desired allocation.

Figure Out Your Goal

Investors may purchase precious metals for inflation protection or as insurance against market downturns.

These objectives are distinct.

Gold generally retains value during inflation and market downturns. Silver, due to its industrial applications, may decline during economic slowdowns despite being a precious metal.

For consistent inflation protection, gold is typically more reliable than silver.

The Budget Question

Augusta requires a minimum of $50,000 to open an account. This threshold is intentional.

It enables the company to assign a dedicated customer success agent and maintain a high level of service.

If you have $100,000 or more in traditional retirement accounts, meeting this minimum is manageable. Augusta recommends allocating only a portion of your retirement savings to precious metals.

Product Selection Process

Your assigned specialist reviews options without pressure. Many clients begin with a 60-70% allocation to gold and 30-40% to silver.

This allocation offers inflation protection and exposure to potential growth in industrial demand for silver.

[Get a free consultation to discuss your specific situation here]

Your financial advisor can help determine the appropriate allocation for your situation. Augusta’s team provides information but does not replace your existing advisors.

Setup and Getting Started

Setting up a self-directed IRA can be more complex than a standard brokerage account, but Augusta manages most of the process.

Choosing a Custodian

Augusta assists you in selecting an IRS-approved custodian. The custodian holds legal title to your metals and ensures your account continues to be tax-qualified.

Augusta partners with established custodians, allowing you to choose from vetted options rather than searching independently.

Custodians charge annual fees ranging from $150 to $300, depending on account value. Augusta manages the majority of the required paperwork.

You are responsible only for signing documents and confirming your selections.

Funding Your Account

You can fund your account through a direct transfer from an existing IRA or a rollover from a 401(k). If permitted by your employer’s plan, funds can be moved without triggering a taxable event.

This method allows you to reposition retirement savings without incurring income taxes, so you are not required to use after-tax dollars to purchase metals.

The transfer procedure generally takes 5 to 10 business days, depending on your current custodian’s processing time.

Selecting Your Metals

Once your account is funded, you select specific gold and silver products with guidance from your specialist.

They explain which coins offer optimal liquidity, how premiums differ by product, and how your selections impact diversification.

The metals selection procedure generally takes 30 to 45 minutes and does not require numerous minor decisions.

You establish an allocation that corresponds with your investment objectives.

Delivery and Storage

Your metals are shipped with full insurance to your chosen depository. The process from purchase to vault storage typically takes about 10 days.

You receive periodic statements detailing your holdings. Physical delivery is available upon request, but may have tax implications that should be discussed with your accountant.

Advanced Tips and Tricks

After consulting with Augusta and reviewing industry forums, I identified multiple approaches that may not be readily obvious.

Most financial professionals recommend allocating 5 to 15 percent of retirement assets to precious metals. Smaller allocations, under 10 percent, serve as insurance.ork as insurance.

These allocations protect against tail risks without saturating your portfolio.

Larger allocations, 15 percent or more, indicate a heightened concern about inflation or currency instability.

A wise strategy is to accumulate metals gradually rather than making a single large purchase, as markets fluctuate.

For example, purchasing $10,000 in gold each quarter may reduce risk compared to a single $50,000 purchase.

Understanding Premiums

All gold IRA companies charge premiums above the spot price. Augusta’s premiums are consistent according to industry standards.

You are not paying more than you would with comparable providers.

The markup covers dealer margins, storage setup, insurance, and IRS-compliant handling. These are legitimate costs.

When comparing companies, consider more than just premiums. Lower premiums may be offset by poor customer service.

Inadequate service can result in extended ambiguity about your account setup.

Use Their Education Resources

Augusta offers free webinars, video guides, and one-on-one sessions with investment advisors. These resources are educational rather than promotional.

They’re educational content designed tThey are designed to help you understand the precious metals markets.ater wish they hadn’t. Understanding why you own gold makes you a more patient investor when prices bounce around.

[Access Augusta’s free educational resources here]

The Buyback Program

Augusta offers a buyback program for liquidation. You can sell metals back at fair market value, with proceeds directed to your custodian.

This program eliminates the need to negotiate with multiple dealers and delivers a simple exit strategy.

Resolving Frequent Issues

Several common questions arise when researching Augusta Precious Metals. The following handles these directly.

Emergency Access to Funds

Your metals are stored in a secure vault. Withdrawing them requires time and may have tax implications if you are under 59½ years old.

Early withdrawal penalties apply to IRA accounts.

Emergency access to precious metals is not practical. Maintain separate emergency funds for immediate liquidity needs.

Tracking Account Value

Your custodian provides quarterly statements. You can also monitor your metals’ value by referencing current gold and silver spot prices online.

Account values fluctuate daily with market prices. This volatility may surprise those accustomed to stable bond or dividend stock values.

Account values will rise and fall over time.

This is typical for commodity investments.

Selling Your Metals

There is no penalty for selling metals within an IRA, as the IRA structure manages tax treatment.

However, early withdrawal penalties apply if you remove funds from the account before age 59½.

Selling metals and reinvesting the proceeds in other metals within the same IRA incurs no penalties, as this is considered rebalancing.

Insurance Coverage

Your metals are covered by comprehensive insurance underwritten by London insurers. The policy includes protection against theft, loss, and damage.

This insurance is included in your storage fees, so no additional policies are required.

Why Augusta Stands Out

Augusta’s reputation is built on consistent execution rather than marketing. Customer reviews regularly point out transparency, a no-pressure approach, and reliable support.

The A+ BBB rating and absence of complaints with the Business Consumer Alliance reflect a strong record of customer satisfaction.

Augusta agents do not pressure clients into unnecessary purchases. They provide information and customized recommendations to your goals, allowing you to decide at your own pace.

This approach appeals for investors looking for a professional, low-pressure experience.

Unlike some companies that encourage excessive purchases, Augusta listens to clients and respects their individual circumstances.

[Request your free gold IRA guide from Augusta here]

Conclusion and Following Actions

Adding physical gold and silver to a self-directed IRA is more straightforward than it may appear. This Augusta Precious Metals guide demonstrates that the method consists of standard paperwork, clear choices, and ongoing support from knowledgeable professionals.

Your next step is to assess your financial goals. Are you seeking insurance against inflation?

Are you concerned relating to potential financial slumps?

Do you have $50,000 or more in existing retirement accounts that you would consider reallocating?

If these questions resonate, requesting Augusta’s free guide is a appropriate next step. Their specialists will review scenarios customized for your situation with no obligation.

The company’s lifetime account support ensures you are not making decisions alone. Once you invest, you have access to dedicated professionals who answer questions, provide market updates, and help you adjust your approach as required.

Protection for retirement savings shouldn’t feel like guesswork. Whether Augusta turns out to be right for your situation or you go a different route, understanding your options is the first step toward retirement confidence.

The $50,000 minimum is designed for serious investors. If you are committed to diversifying a substantial retirement account, Augusta offers the education and assistance required for well-informed choices. Their experience since 2012 shows a solid track record.

[Start your free consultation with Augusta Precious Metals today]